- Raise like a Pro

- Posts

- Raise like a PRO - Competing in the new game...

Raise like a PRO - Competing in the new game...

...and not losing like the old game

Table of Contents

Introduction

The biggest pile of tosh in your investment deck is your competition slide.

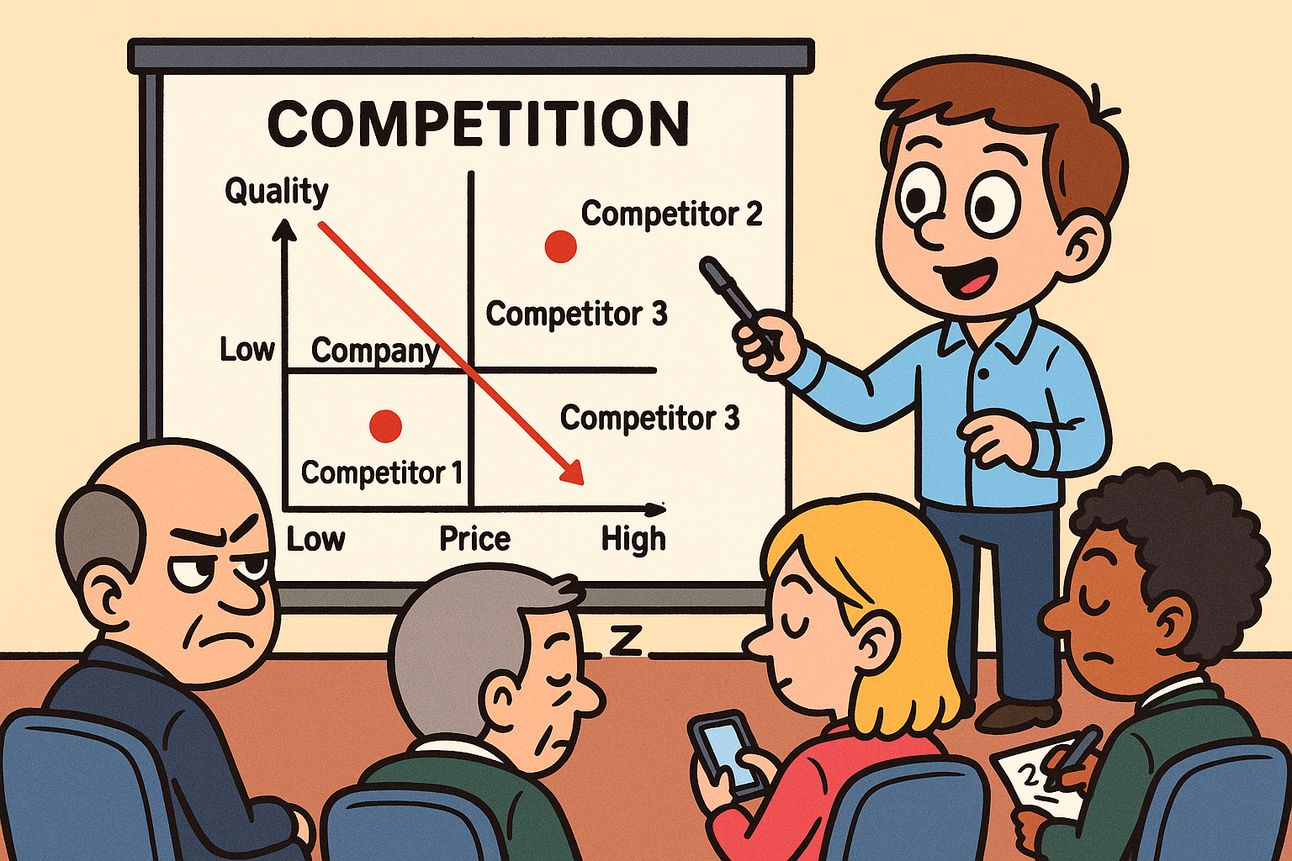

That dreary quadrant where you've magically placed yourself in the top-right corner, with your competitors scattered around like sad, forgotten snacks at a half-arsed networking event. Everyone in the room knows it's complete fantasy—including you.

Investors sit there, holding back eye-rolls, while you proudly point to a chart that's about as truthful as a politician's campaign promise.

You know that. They know that. Yet both sides seem to play the game. And it’s something I see every single day when working with founders.

I get it’s not easy - how do you articulate why you’re really/truly/deeply different than others that appear to do the same or better than you in a way which is meaningful, truthful and actually makes sense?

💰 Deals done this week

SimpleClosure, a Santa Monica, CA-based platform to shut down a startup, raised $15m in Series A funding. (Read)

Rove, a San Francisco, CA-based universal airline mile loyalty startup, raised $2M in seed funding from Y Combinator, General Catalyst, and Soma Capital. (Read)

Gardin, an Oxford, UK-based company developing an optical photosynthesis sensor and AI, raised $4.5M in Seed 2 funding. (Read)

Inductive Bio, a NYC-based technology company that advances artificial intelligence (AI) models for small molecule drug discovery, has raised $25M in Series A funding. (Read)

Jericho Security, an NYC-based AI-powered cybersecurity training and conversational phishing defence platform, raised $15M in Series A funding. (Read)

Learn to Raise like a Pro

Fundraising isn’t insanely complex.

But it’s hard. It's emotionally hard. You'd rather be spending that time building your product, acquiring your first customers, and recruiting the team to join you on this rollercoaster of a journey

Last year, I put together what I thought was a basic and fairly rudimentary programme; my playbook for how I spend my days raising money for startups all over the world from investors all over the world. It is literally the ABC of how I do it, but the response took me back and was quite phenomenal if also a bit scary.

Now I'm creating the next level of training programme and I'm looking for ten super ambitious, super excited, and super committed founders to help me create the next generation of a training programme to help you raise like a pro. Founders who want to raise smarter, faster, and with less stress.

You’ll get direct help from me, clarity on what gets a “yes,” and the rare chance to be part of something I won’t offer ever again - at a fraction of what I’d usually charge.

If you’re in the fundraising trenches (or heading there soon), this could change everything…

I break it all down in a quick 10-minute video.

Take a few minutes to watch - but it will save you months of confusion, spinning wheels, and missed opportunities.

The Competition Slide Conundrum: Why We're All Playing the Wrong Game

Everyone knows you have talk about your competitors. You’ve never the first and you’re never the only.

And if you are? Big fat red flag in and of itself.

But the way you talk about competition matters. And it’s usually either the dreaded quadrant slide or the nonsensical feature matrix.

Both of these suffer from the same problems: this is purely your view from your (highly-biased) perspective, doesn’t place things into the right context and is really far from reality. The quadrant has you in the top right and everyone else scattered throughout the slide; if you’re feeling particularly magnanimous you might populate a bunch of your competitors in and around the centre. And if it’s the matrix - you’ll have all green ticks and lots of red for everyone else.

You know it’s rubbish, the investor knows it’s rubbish yet everyone plays the same game.

Until now.

The Quadrant Slide Theatre We’re All Participating In

The traditional competition slide is pure theatre. You place yourself in the top-right quadrant of that 2×2 matrix, position your competitors strategically around the board (conveniently away from your special spot), and everyone pretends this represents reality.

The problem? You only have a fractional understanding of what your competitors are actually capable of. You’ve probably spent a few hours on their websites, maybe tried their demo if they have one, and done some cursory research. You don’t know their roadmap, their true technical capabilities, or their strategic plans.

And all the investors know this too. They’re sitting there thinking, “This is absolute tosh; I can’t put this in front of my investment comittee.” It’s a bizarre dance where both parties know the steps are meaningless, yet we keep dancing.

Why We Need to Change the Game Entirely

The real issue isn’t that your competition matrix is inaccurate – it’s that you’re framing the conversation entirely wrong. Rather than positioning yourself as doing the same thing but slightly better (faster, cheaper, more features), what if you redefined the category itself?

An excellent article I often quote on Medium explains this brilliantly. Andy Raskin argues that the most successful companies don’t just compete within an existing framework – they “name a new game” entirely. They shift from saying “we’re better at X” to declaring “X is the old way; the new way is Y, and we’re leading that charge.”

Think about it: Salesforce didn’t just say they were better at CRM software; they declared “No Software” (or “Cloud Software”) was the new game. Gong didn’t merely improve sales analytics; they created “Revenue Intelligence.” These companies aren’t playing the same game better; they’re playing an entirely different game.

Old Game vs New Game Thinking

When you create your competition slide, you should be thinking about:

Old Game: What’s the traditional way people solve this problem? What rules and assumptions govern this space?

New Game: How has the world fundamentally changed, making the old approach obsolete?

New Winners: Who’s already playing this new game (ideally, you)?

Old Losers: Who’s still stuck in the old paradigm?

This framing completely changes your competition slide from “here’s how we compare on features and price” to “here’s why the entire category has been redefined, and we’re leading that redefinition.”

The AI Revolution Has Changed Everything (Again)

Here’s where things get even more interesting in 2025. We’re now in an era where the competitive landscape has been fundamentally reshaped by AI.

Think about it: with modern AI-powered development tools, you can build in days what used to take months or years. Any technical advantage you might have developed is increasingly temporary at best. Unless you’re in deep tech with genuine IP protections or complex scientific breakthroughs, your technology itself is unlikely to be a sustainable competitive advantage.

Consider how rapidly AI code generation has evolved. Nearly any competent engineer with access to the right AI tools can replicate most features of your platform in a matter of days, not years. The barriers to entry for building sophisticated software have collapsed.

This means your competition slide shouldn’t focus primarily on technology advantages – because those advantages are increasingly ephemeral.

Distribution Is the New Moat

If technology isn’t a sustainable advantage anymore, what is? In one word: distribution.

Your real competitive advantage now lies in your ability to:

Identify your ideal customer profile (ICP) with laser precision

Reach those customers at hyperscale speed

Build the systems that make acquisition, conversion, and retention repeatable

The winners in 2025 aren’t those with the best technology (though you still need that as table stakes), but those who’ve built the most efficient customer acquisition and retention engines. Your moat is your ability to find the right customers and get to them faster than anyone else.

This shift in competitive advantage should be reflected in how you present your competition slide. Rather than focusing exclusively on feature comparisons, you should be explaining:

How your understanding of the customer is deeper and more nuanced

Why your go-to-market strategy is fundamentally different (and better)

How you’ve solved the distribution puzzle in ways your competitors haven’t

Building a Competition Slide That Actually Matters

So, how do we apply all this to create a competition slide that isn’t complete rubbish? Here are some practical approaches inspired by the ideas in the Medium article:

Frame it as “Old Game vs New Game” - Instead of a traditional matrix, consider creating a slide that contrasts the old way of doing things with the new paradigm you’re pioneering. This immediately positions you not as a slightly better alternative, but as a category-defining company.

Focus on Customer Jobs-to-be-Done - Rather than listing features, focus on how well different competitors fulfill the actual jobs customers need to get done. This shifts the conversation from “who has more features” to “who actually solves the customer’s problem most effectively.”

Highlight Distribution Advantages - If distribution is the new moat, then showcase your unique channels, customer acquisition strategies, and other elements of your go-to-market motion that give you a real edge.

Use Alternative Visual Formats - There are more compelling ways to visualize your competitive advantage than the tired quadrant. Consider formats that show how you’re unbundling complex solutions or bundling fragmented ones. For example, one effective slide design “shows a solution that unbundles a niche feature from a typically large suite of software.” Another demonstrates how a company “bundles several solutions into one.”

Be Honest About Competitors’ Strengths - Nothing shows confidence like acknowledging where competitors are strong. This level of intellectual honesty signals to investors that you genuinely understand the market and aren’t just painting a self-serving picture.

The New Game of Competition Slides

At the end of the day, your competition slide isn’t really about competition at all. It’s about your strategic narrative – how you’re positioning yourself in a changing market and why that positioning makes you uniquely valuable.

As the Medium article highlights, the most successful companies act “as if it’s the category narrative they’re selling, not their own company or products.” They’re evangelising a new way of seeing the world, a new approach to solving problems that makes the old way look obsolete.

Your competition slide should be the visual manifestation of this narrative. It shouldn’t just show how you compare to others; it should redefine what comparison even means in your space.

Conclusion: Playing a Better Game

The quadrant slide isn’t going away anytime soon – investors still expect to see something addressing the competitive landscape. But you don’t have to play by the old, intellectually dishonest rules.

Instead, use your competition slide as an opportunity to demonstrate that you’re not just better at the same game – you’re playing an entirely new game altogether. Show that you understand how AI and other forces have changed what constitutes a sustainable advantage. Demonstrate that you’ve built your strategy around distribution and customer acquisition, not just feature development.

In doing so, you’ll transform one of the most eye-roll-inducing slides in your deck into one of the most compelling. And more importantly, you’ll be telling the truth about what really matters in competition today.

Because in 2025, the winners aren’t those who compete better – they’re those who redefine what competition even means.

This article draws heavily on the insightful ideas presented in the Medium piece “To Create a New Category, Name the New Game,” which I highly recommend for any founder tired of the same old competition slide nonsense.

🤖 AI in fundraising

Fundraising is time-intensive and distracts from what matters - building the business. Emerging AI tools will help you save time whether summarising investor requests, preparing for meetings, or managing due diligence materials.

But even more than tools for fundraising, AI is a game-changer in building out your business.

I’ve recently been vibe-coding a number of tools; what you can build merely by talking to an AI is literally insane.

Have a go - look at replit, Loveble.dev and Cursor.

My promise to you

Every piece of advice in this newsletter comes from actual experience: deals I've closed, terms I've negotiated, and strategies I've refined through real-world application.

I'm not here to give you startup platitudes or generic advice. Instead, you'll get practical, actionable tactics that you can implement immediately in your fundraising journey.

The goal? To help you raise money faster, at better valuations, while protecting your interests and your time.

– David

About Raise Like a Pro

Raising a funding round isn’t rocket science. It’s not even brain surgery. But it's incredibly time-consuming, HARD and emotionally challenging.

As a founder, your time is better spent building product, finding product-market fit, signing up customers, and building your team. Yet fundraising demands an enormous amount of your attention and energy.

I've witnessed countless founders struggle with this balance. They get stuck in the cycle of endless pitch meetings, confusing feedback, and the dreaded "no's" that seem to pile up without explanation. Even successful companies like Canva, now valued at $25.5 billion, started with their CEO Melanie Perkins hearing "no" over 100 times before getting that crucial first "yes."

I'm going to share my exact playbook – the same one I use to raise millions for startups across the world. This isn't about theory or inspiration. Instead, you'll get:

The actual processes I use to close deals.

Step-by-step morning routines for effective fundraising.

Real email templates that get responses.

Meeting scripts that convert to term sheets.

Pipeline management techniques that close deals.

The stuff you really need to know so you don’t get screwed by investors.

My days are spent navigating negotiations with every type of investor: angels looking for their next big win, syndicates pooling capital for bigger deals, and VC firms conducting thorough due diligence.

I'll share insights from all these perspectives, helping you understand how each type of investor thinks and what they're really looking for.

Raise like a Pro is what David Levine does every single day though this business Glenluna Ventures. An exited founder, he raises money each and every day for founders all over the world from investors all over the world.