- Raise like a Pro

- Posts

- Raise like a PRO - The secret scorecard investors are judging you by

Raise like a PRO - The secret scorecard investors are judging you by

...and how to use it to your advantage

Welcome to Raise Like a Pro reader! ; a new newsletter to help you do exactly that.

I'm David, and unlike most people giving fundraising advice, I don't just talk about raising money – I’ve been there as a founder and now I spend my day raising money for startups all over the world from investors all over the world.

I've closed millions in new investment in the past few months alone for startups - and I’m going to teach you how to do it without needing someone like me. This is my playbook; the operational, tactical and yes - sometimes boring stuff you need to do each and every day to raise your round.

No nonsense, no fluff and definitely no fuzzy sheep.

Table of Contents

The reality check

Raising a funding round isn’t rocket science. It’s not even brain surgery. But it's incredibly time-consuming, HARD and emotionally challenging.

As a founder, your time is better spent building product, finding product-market fit, signing up customers, and building your team. Yet fundraising demands an enormous amount of your attention and energy.

I've witnessed countless founders struggle with this balance. They get stuck in the cycle of endless pitch meetings, confusing feedback, and the dreaded "no's" that seem to pile up without explanation. Even successful companies like Canva, now valued at $25.5 billion, started with their CEO Melanie Perkins hearing "no" over 100 times before getting that crucial first "yes."

I'm going to share my exact playbook – the same one I use to raise millions for startups across the world. This isn't about theory or inspiration. Instead, you'll get:

The actual processes I use to close deals.

Step-by-step morning routines for effective fundraising.

Real email templates that get responses.

Meeting scripts that convert to term sheets.

Pipeline management techniques that close deals.

The stuff you really need to know so you don’t get screwed by investors.

My days are spent navigating negotiations with every type of investor: angels looking for their next big win, syndicates pooling capital for bigger deals, and VC firms conducting thorough due diligence.

I'll share insights from all these perspectives, helping you understand how each type of investor thinks and what they're really looking for.

What's coming up

In the next issues, we'll dive into a whole bunch of stuff including:

How to structure your fundraising for maximum efficiency

The exact outreach strategies I use to get investor meetings

Common terms to watch out for (and how to negotiate them)

Ways to create competitive tension in your raise

Due diligence preparation that speeds up closing

My promise to you

Every piece of advice in this newsletter comes from actual experience: deals I've closed, terms I've negotiated, and strategies I've refined through real-world application.

I'm not here to give you startup platitudes or generic advice. Instead, you'll get practical, actionable tactics that you can implement immediately in your fundraising journey.

The goal? To help you raise money faster, at better valuations, while protecting your interests and your time.

– David

What is the investor scorecard?

The way VCs make decisions can seem opaque to founders particularly when that decision is a no. Sometimes VCs deliver feedback to the founders but often they don’t. And even when they do - it doesn’t describe the actual process behind how decisions are made within the walls of a VC.

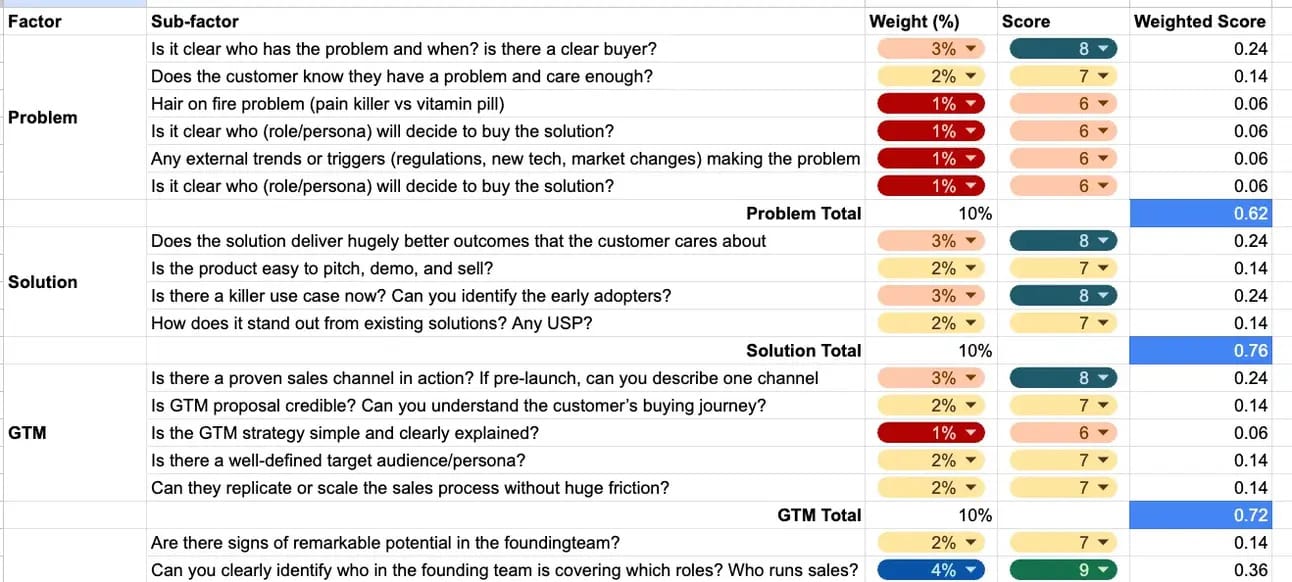

An Investor Scorecard is how early-stage VC investors assess the potential of your startup. It provides a structured framework for comparing similar ventures and adjusting valuations based on specific factors. These factors include:

Management Team

Market Opportunity

Product

Traction

Competition

We’ve examined the scorecards of dozens and dozens of tech investors around the world and have spent months talking to and collating feedback as to what a typical investor scorecard looks like.

In our in-depth section (below), we deep dive into an investor scorecard and give you the one investor scorecard to rule them all that represents the best of what we’ve seen.

Once you understand how decisions are made, you can optimise your approach and deck to get to yes!

💰 Deals done this week

ElevenLabs raised $250M Series C, reaching a $3B valuation, making it the UK’s most valuable AI company. The AI audio startup, founded in 2022 by ex-Palantir and Google employees, plans to expand its London presence read more.

Yavrio secured $2.4M seed funding led by Fuel Ventures to modernise ERP systems, replacing error-prone CSV imports with direct bank connections for real-time financial insights read more.

Smartify raised £1.5M led by Metavallon VC to expand its cultural audio guide app, which serves 700+ museums globally and has grown 68% YoY read more.

Zelt secured $6M seed funding led by Nauta Capital to scale its HR, Finance, and IT management platform. It serves 150+ customers, including Shakespeare’s Globe and Mumsnet read more.

Prosper raised £4M, including £2M from Fuel Ventures, to expand its AI-powered wealth management platform, managing £200M+ in assets and launching private market investments read more.

Sightline raised $5.5M (£4.4M) seed funding, co-led by Molten Ventures, to expand its climate market intelligence platform, serving 70+ clients, including HSBC and the US DOE. read more.

Iplicit secured £25M from One Peak to scale its cloud accounting platform. Founded in 2019, it has achieved triple-digit revenue growth, serving 2,000+ organisations with 38,000 daily users read more.

Behind closed doors: How investors really make decisions

Picture this: A startup founder just finished their pitch and left the room. The door clicks shut, and that's when the real action begins.

The investors' poker faces dissolve, and the raw, unfiltered assessment starts.

What happens next isn't the mystical black box many entrepreneurs imagine – it's actually a surprisingly structured process, centred around what we call the investor scorecard.

The scorecard: More than just numbers

Here's what most founders don't realise: by the time they've finished their pitch, investors have already been mentally filling out a detailed scorecard in their heads.

Think of it as a report card for your startup, but instead of grades in maths and science, you're being evaluated on things like market potential and team chemistry.

But this isn't your typical "rate it 1-10" evaluation. The reality is messier and more nuanced. Let me take you inside a typical post-pitch investor discussion…

The first five minutes: The gut check

The moment the founder leaves, there's usually a burst of raw, unfiltered reactions. You'll hear things like:

"Did you see how they handled the unit economics question?"

"I worked with their CTO at Google – she's brilliant."

"The market size feels inflated."

These initial reactions matter more than you'd think. Investors are human, and that first impression often forms the emotional foundation for the more analytical assessment that follows.

Breaking down the real scorecard

The actual evaluation typically breaks down into five core areas:

1. Team DNA

The conversation around team assessment is brutally honest. Investors aren't just looking at resumes – they're digging into the intangibles.

Has the CEO built and scaled before? Do they have domain expertise? But more importantly, did they show the kind of adaptability and coachability that suggests they can evolve with the company?

One partner might say, "sure, they're first-time founders, but did you notice how they handled that supply chain question? They'd clearly done their homework and weren't afraid to admit what they didn't know."

2. Market opportunity

This is where the gloves really come off.

Investors will tear apart market size assumptions, question growth projections, and debate whether the timing is right. The key questions aren't just about TAM (Total Addressable Market) – they're about why now is the right time for this solution.

"Everyone's talking about AI in this space, but these guys actually have a compelling reason why AI matters for their specific customer pain point."

3. Product differentiation

The discussion here often gets technical.

Investors will bring in domain experts or technical partners to pressure-test the innovation claims. They're looking for sustainable competitive advantages, not just cool features.

"The tech is solid, but what stops Google from building this in six months?"

4. Traction and metrics

Numbers don't lie, but they can mislead. Investors dig beyond the headline metrics to understand the story behind the growth. They're looking for evidence of product-market fit and sustainable unit economics.

"The growth is impressive, but look at these cohort retention numbers – they're actually improving over time. That's rare."

5. Deal terms and exit potential

This is the pragmatic finale – can this investment make money?

The discussion centres around valuation, terms, and potential exit scenarios. It's where the excitement of innovation meets the reality of venture returns.

The hidden factors

What most founders don't realise is that there are usually unspoken factors at play:

Portfolio fit: How does this investment align with the firm's other companies?

Partner bandwidth: Who's going to take the board seat and actually help this company?

Fund lifecycle: Where is the VC firm in their current fund, and how much ‘dry powder’ (uncommitted funds) do they have left?

The decision process

Contrary to popular belief, investment decisions rarely happen immediately after the pitch. Instead, there's usually a multi-step process:

Initial discussion: The immediate post-pitch debrief

Due diligence deep dive: Assigning partners to dig into specific areas of concern

Follow-up questions: Usually via email or follow-up meetings

Partner meeting presentation: Where the deal sponsor presents to the partnership

Final decision: Often requiring unanimous or majority partner approval

The Human Element

Investor scorecards are guidelines, not gospel.

I've seen deals with mediocre scores get done because one partner had an unshakeable conviction about the founder. I've also seen apparently perfect scores get passed on because something just didn't feel right.

What this means for founders

Understanding this process is crucial for founders. The best ones prepare not just for the pitch, but for the discussion that happens after they leave. They:

Provide clear, memorable points that investors can use to advocate for them in partner meetings

Address potential concerns proactively

Leave behind materials that answer the questions they know will come up

Follow up with additional data or clarification before being asked

The bottom line

At the end of the day, while investor scorecards provide a framework, venture capital remains as much an art as a science.

The best investors know when to trust the scorecard and when to trust their gut. The best founders understand this dynamic and prepare accordingly.

Remember, behind every "no" or "yes" is usually hours of debate, discussion, and deliberation. The scorecard is just the beginning of the story.

Get your own investor scorecard

We’ve spent months talking to and interviewing VCs all over the world who very kindly (and confidentially) shared their super-secret scorecards with us. Sometimes it felt like espionage getting to the meat on this stuff!

But now we’ve created the one scorecard to rule them all - a single scorecard that pulls together all of that intelligence which you can use to get your answer to a yes.

Click here to get your full scorecard!

🤖 AI in fundraising

Fundraising is time-intensive and distracts from what matters - building the business. Emerging AI tools will help you save time whether summarising investor requests, preparing for meetings, or managing due diligence materials.

Here are a couple of tools that have been a game changer for me recently:

NotebookLM from Google is the best tool I've seen for retrieving key information from documents and summarising notes. If you're a podcast nerd like me, the tool can even convert a boring report you need to read into a two-expert conversation that is far easier to take in. If you haven't already, try it here.

Humble AI is a great tool to build your own mini personal assistants. With Humble could save you a list of web pages or LinkedIn profiles you're visiting as you go, scrape the speakers for your next event, and much more. Explore here.

📖 Interesting things I’ve been reading….

Raise like a Pro is what David Levine does every single day though this business Glenluna Ventures. An exited founder, he raises money each and every day for founders all over the world from investors all over the world.