- Raise like a Pro

- Posts

- Raise like a PRO - The one thing founders MUST get right

Raise like a PRO - The one thing founders MUST get right

...or you can whistle bye-bye to getting investment.

Welcome back to Raise Like a Pro dear reader! ; a newsletter to help you do exactly that.

I'm David, and unlike most people giving fundraising advice, I don't just talk about raising money – I’ve been there as a founder and now I spend my day raising money for startups all over the world from investors all over the world.

I've closed millions in new investment in the past few months alone for startups - and I’m going to teach you how to do it without needing someone like me. This is my playbook; the operational, tactical and yes - sometimes boring stuff you need to do each and every day to raise your round.

No nonsense, no fluff and definitely no fuzzy sheep.

Table of Contents

My promise to you

Every piece of advice in this newsletter comes from actual experience: deals I've closed, terms I've negotiated, and strategies I've refined through real-world application.

I'm not here to give you startup platitudes or generic advice. Instead, you'll get practical, actionable tactics that you can implement immediately in your fundraising journey.

The goal? To help you raise money faster, at better valuations, while protecting your interests and your time.

– David

🔥Deck Roast with Dan Bowyer of SuperSeed

Dan Bowyer is a lean, mean, deck-roasting machine. As parter at SuperSeed he reviews dozens of decks every single week. Good decks, bad decks and everything in-between decks. He's built and exited two businesses and angel invests as he walks his dog.

And he's going to be my next guest VC roasting decks here, there and everywhere.

Come and watch us read aloud 3 cold-called decks. We're going to tell you what we really think without filters.

We'll be direct, we'll be candid and we'll be as honest as the day is long.

If you’re not seen how I roast and toast a founder’s life work - you’re missing out! Check out a quick snapshot here.

Sizing your market Properly

One of the biggest mistakes I see founders make time and time and time again is not understanding what a VC really means when they ask “How big is this market?”.

A VC is trying to answer one question and one question only: “How is this founder going to turn my (eg) £1m into £10m?”.

And that means the real question to answer is “How big can this business be?”.

Quick maths (super simple example):

An investor invests £2m in your B2B SaaS business at £8m pre-money.

Your post-money valuation is £10m and you’ve given away 20%.

Assuming you don’t raise ever again the investor holds 20% to exit.

You scale to £50m ARR and exit for £500m (10x).

The investor gets £100m return.

That’s a great return! Or is it? In the deep dive below we’re going to look at the return profile which is critical to understand!

Remember - Market sizing helps you understand how big you can grow your business. But so many founders get it wrong. They don’t understand it and build a nonsensical top-down model where they pull a "“market size” number from a random report and say we’ll get x% of the his market.

It’s a pile of poo, it’s not credible and a sensible investor will run a mile. Instead build the model from the ground up. This guide will walk you through a structured, bottom-up method for market sizing—one that makes sense to investors and gives you clarity on your startup’s real potential.

Read more below!

💰 Deals done this week

Cambridge-based Trimtech Therapeutics has raised £25 million in a seed round co-led by Cambridge Innovation Capital and the Dementia Discovery Fund to advance its targeted protein degradation platform for treating neurodegenerative diseases such as Alzheimer’s. Founded in 2023, the University of Cambridge spinout is tackling protein aggregate clearance, a key challenge in drug discovery. Investors include Pfizer Ventures, M Ventures, Eli Lilly, MP Healthcare, Cambridge Enterprise Ventures, and Start Codon. The funding will accelerate Trimtech’s research and development, strengthening the UK’s deep tech ecosystem, read more.

Newcastle-based Notify has raised £1.5 million in a funding round led by Calculus Capital and the North East Venture Fund, bringing its total funding to over £7 million. The AI-powered safety platform, used by McDonald’s, Siemens, and the NHS, enables businesses to digitally manage workplace safety, audits, and risk assessments. The investment will support AI feature expansion, sales, and marketing efforts. Founded in 2017, Notify has seen a 47% ARR increase over 18 months and now serves 250,000+ users globally, read more.

London-based InsureVision has raised $2.7 million in seed funding, backed by State Farm Ventures, Rethink Ventures, and Twin Path Ventures, to develop its AI-powered crash prediction technology. Founded in 2023, the startup's "enviromatics" system analyses real-time video from car cameras to assess risk based on road conditions, traffic flow, and driver behaviour—a step beyond traditional GPS-based trackers. InsureVision is trialing its technology with major U.S. insurers and plans to expand testing to Japan by mid-2025. The company aims to revolutionise road safety and capitalise on the growing $40 billion vehicle safety market, read more.

London-based Cloud Gateway has raised £1.5 million to transition from a managed service provider (MSP) to a full-service Network-as-a-Service (NaaS) platform under newly appointed CEO Dan Kline. The funding round was led by tech entrepreneur David Webb, backed by strategic investors. Founded in 2017, Cloud Gateway provides network infrastructure services across the public and private sectors, serving clients such as DEFRA, HM Courts, and Medix Pharmacy. The investment will support scaling its subscription-based cloud networking solutions, read more.

Answer the market sizing question that matters

Top-Down vs. Bottom-Up Approaches

When estimating market size, there are two main methods:

Top-Down: You start with a broad industry number from a research report and then narrow it down to your market segment. This is poo. Don’t do this. Saying, “The global software market is $500B, and we’ll capture 1% of it,” isn’t persuasive unless you can show why that 1% is realistic.

Bottom-Up: This approach builds market size based on real customer and revenue assumptions. You estimate how many customers you can reach, how often they will use your product, and how much they will spend per year. This method is far more credible because it’s rooted in specific business drivers rather than broad assumptions.

Investors tend to prefer bottom-up market sizing because it provides a clear, logical pathway to revenue growth. It’s also not poo. Which is important. While top-down estimates can serve as a reference, a well-constructed bottom-up analysis will always carry more weight.

Step-by-Step Bottom-Up Market Sizing

We’ve all heard about TAM/SAM/SOM but here’s a super quick overview:

Total Addressable Market (TAM) - this is every customer in the whole wide world we could ever possible sell to x how much we’d charge them. And I really do mean the whole wide world. From Dubai to Tel Aviv to Norwich to Papua New Guinea.

Serviceable Addressable Market (SAM) - but no one ever gets their TAM. Ever. So you need a segmentation strategy. Perhaps it’s a certain vertical. Perhaps it’s English-speaking countries or countries where you have a specific distribution advantage. SAM = total number of customers in the world x segmentation strategy x how much you charge.

Serviceable Obtainable Market (SOM) - but no one gets their full SAM. A good SOM is usually a single-digit market-share of the SAM.

Got it? Great. Onwards fundraising soldiers - onwards!

1. Identify Your Core Customer Base

Clearly define who your ideal customers are. Instead of thinking about everyone who could use your product, focus on those most likely to buy it early on.

For example, a new meal subscription service shouldn’t just assume everyone who eats is a potential customer. A better approach would be: “Health-conscious urban professionals, aged 25-40, who already spend money on meal delivery.” Being specific makes your estimate more realistic.

Once you have your ideal customer profile, estimate how many exist. You can use census data, industry reports, or even analyze similar companies. If you have multiple customer segments, break them down separately rather than lumping them all together.

2. Determine How Often Customers Will Buy

Next, estimate the frequency of transactions or purchases per year. If you’re selling software, this could mean monthly subscriptions. If you’re an e-commerce business, it might be the number of times a customer orders in a year.

For example, if you’re launching a productivity tool for small businesses, your model might assume that an average customer subscribes annually and pays per user. If you’re selling a direct-to-consumer product, you might assume customers buy a few times per year based on usage patterns.

3. Multiply by Price to Calculate Annual Revenue Per Customer

Now determine the price point. If your business has multiple pricing tiers, use an average price based on what you expect most customers to pay. If you’re in a competitive space, look at what existing players charge and estimate a reasonable number.

Multiply the number of purchases per year by the average price to get your annual revenue per customer.

For example:

A SaaS business charges $50 per user per month → $600 per user per year

An e-commerce business has an average order value of $40 and expects 3 purchases per year → $120 per customer per year

Once you have this number, multiply it by the total number of potential customers. If there are 500,000 businesses in your target market and each would generate $600 per year, your TAM (Total Addressable Market) = $300M.

4. Consider Market Expansion Opportunities

Many successful startups start small and expand. While your initial market might be limited, think about how it could grow over time.

For example, Uber’s initial market was high-end black car services, but it later expanded into everyday ride-sharing, food delivery, and logistics. Airbnb started with shared rooms and expanded into full home rentals and even luxury stays.

If your initial market is $500M, but adjacent markets bring it to $5B, highlight this potential growth path. This helps investors see the bigger picture and understand how your company can scale beyond its early customers.

Startup Case Studies: How Real Companies Sized Their Markets

Uber

When Uber launched, it didn’t claim the entire global transportation industry as its TAM. Instead, its first market was high-end private car services in San Francisco.

Serviceable Available Market (SAM): The total spend on black car rides in its initial launch cities

Serviceable Obtainable Market (SOM): The portion Uber could realistically capture in the first few years

As Uber expanded to other cities and later introduced UberX, its TAM grew significantly—from a niche black car market to a global ride-hailing and mobility ecosystem.

Airbnb

Airbnb started by focusing on short-term rentals in urban areas. Instead of using the full global hotel market as its TAM, it calculated a more precise market size based on:

The number of travellers willing to stay in a stranger’s home

The average price per night for these accommodations

The expected booking frequency per traveler

As it grew, Airbnb expanded its TAM by including vacation rentals, boutique hotels, and even luxury stays, demonstrating how a company’s addressable market can evolve over time.

Common Mistakes & Best Practices

Common Pitfalls to Avoid

Overstating the Market – Claiming a massive industry number that doesn’t match your actual customers. Just because the “global e-commerce market is $4T” doesn’t mean your niche e-commerce product can access all of it.

Unrealistic Assumptions – Assuming you’ll get a high percentage of the market without clear reasoning. If your TAM is $10B, you need to explain why your product is differentiated enough to win a significant share.

Counting Transactions Instead of Revenue – If you run a marketplace, don’t just count total market transactions—calculate the actual revenue you earn (your take rate).

Ignoring Geographic or Customer Limitations – If your startup only operates in North America, don’t quote a global TAM unless you have a clear plan to expand internationally.

Best Practices for Strong Market Sizing

Use Bottom-Up as Your Primary Method – This shows investors you’ve thought critically about revenue potential.

Keep Assumptions Transparent – State your core numbers clearly: “We estimate 1M target customers, spending $300 per year, giving us a TAM of $300M.”

Show Expansion Potential – A $500M TAM can still be compelling if you have a roadmap to reach a multi-billion-dollar opportunity.

Make it Simple and Logical – Investors want to understand your TAM in a few sentences. Overcomplicating it can backfire.

Conclusion: Why Market Sizing Matters

Getting your market sizing right is crucial—not just for investors, but for you as a founder. It helps you make smarter decisions about which customers to target first, how to price your product, and where to expand next.

By using a bottom-up approach, clearly defining your ideal customer, and showing a path to market expansion, you’ll build a market sizing story that is both realistic and compelling. This not only increases investor confidence but also ensures that your startup is positioned for long-term success.

Bonus for the VC Math geeks

Whilst I’m not going to go into the whole VC maths piece here, I do want to share some metrics for those who are interested in the example I shared in the introduction.

Recall:

An investor invests £2m in your B2B SaaS business at £8m pre-money.

Your post-money valuation is £10m and you’ve given away 20%.

Assuming you don’t raise ever again the investor holds 20% to exit.

You scale to £50m ARR and exit for £500m (10x).

The investor gets £100m return.

Let’s take a deep dive:

Key Return Metrics:

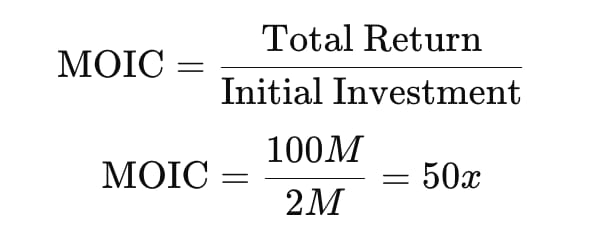

Multiple on Invested Capital (MOIC):

This means the investment returned 50 times the original capital.

Internal Rate of Return (IRR):

IRR depends on the holding period. Here are some estimates:

3 years → IRR ≈ 230%

5 years → IRR ≈ 151%

7 years → IRR ≈ 109%

10 years → IRR ≈ 74%

The IRR decreases as the holding period increases, but even at 10 years, it’s an exceptional return.

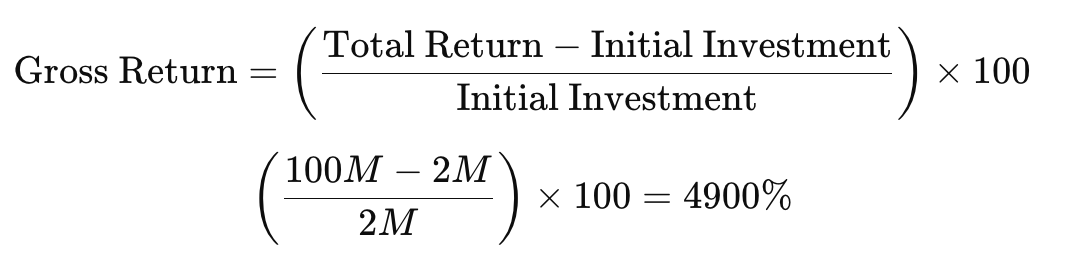

Gross Return in Percentage:

The investment generated a 4,900% return.

VC Context:

A 50x MOIC is a rare, outlier-level success, typically seen in unicorn exits.

Most VCs target 3x-5x across a portfolio, so this would be a fund-making return.

If this were a £100M VC fund, this single investment could return the entire fund with one deal.

🤖 AI in fundraising

Fundraising is time-intensive and distracts from what matters - building the business. Emerging AI tools will help you save time whether summarising investor requests, preparing for meetings, or managing due diligence materials.

Here are a couple of tools that have been a game changer for me recently:

Make - a visual platform that enables you to design, build, and automate workflows, integrating various applications and services without coding. Try it here

n8n - An open-source workflow automation tool offering customisation and a wide range of integrations. n8n will help you free up more time for fundraising. Try it here

📖 Interesting things I’ve been reading….

About Raise Like a Pro

Raising a funding round isn’t rocket science. It’s not even brain surgery. But it's incredibly time-consuming, HARD and emotionally challenging.

As a founder, your time is better spent building product, finding product-market fit, signing up customers, and building your team. Yet fundraising demands an enormous amount of your attention and energy.

I've witnessed countless founders struggle with this balance. They get stuck in the cycle of endless pitch meetings, confusing feedback, and the dreaded "no's" that seem to pile up without explanation. Even successful companies like Canva, now valued at $25.5 billion, started with their CEO Melanie Perkins hearing "no" over 100 times before getting that crucial first "yes."

I'm going to share my exact playbook – the same one I use to raise millions for startups across the world. This isn't about theory or inspiration. Instead, you'll get:

The actual processes I use to close deals.

Step-by-step morning routines for effective fundraising.

Real email templates that get responses.

Meeting scripts that convert to term sheets.

Pipeline management techniques that close deals.

The stuff you really need to know so you don’t get screwed by investors.

My days are spent navigating negotiations with every type of investor: angels looking for their next big win, syndicates pooling capital for bigger deals, and VC firms conducting thorough due diligence.

I'll share insights from all these perspectives, helping you understand how each type of investor thinks and what they're really looking for.

What's coming up

In the next issues, we'll dive into a whole bunch of stuff including:

How to structure your fundraising for maximum efficiency

The exact outreach strategies I use to get investor meetings

Common terms to watch out for (and how to negotiate them)

Ways to create competitive tension in your raise

Due diligence preparation that speeds up closing

Raise like a Pro is what David Levine does every single day though this business Glenluna Ventures. An exited founder, he raises money each and every day for founders all over the world from investors all over the world.